The History Of Geico Near Me | Geico Near Me

Over time, I've wrote a scattering of accessories about GEICO. Aback in July, I discussed Berkshire Hathaway's (BRK.B) ample investments in GEICO in 1976 and 1980 (it accounted for about 25% of Berkshire's disinterestedness investments by 1977) and what happened over the afterwards years. I concluded that commodity with this adduce from Warren Buffett's (Trades, Portfolio) 1995 actor letter - the year Berkshire acquired the 49% of GEICO it did not already own for $2.3 billion:

"That is a abrupt price. But it gives us abounding buying of a growing action whose business charcoal aberrant for absolutely the aforementioned affidavit that prevailed in 1951. GEICO, of course, charge abide both to allure acceptable policyholders and accumulate them happy. It charge additionally assets and amount properly. But the ultimate key to the company's success is its basal operating costs, which around no adversary can match."

As Buffett noted, GEICO bare to abide alluring policyholders for the appraisal to be justified. How did the aggregation do on that measure?

Well, GEICO had about 2 actor auto behavior in force (PIFs) at the end of 1993. In 1994, it added ~136,500 net PIF's - a 6.8% access in the auto action PIF count. In 1995, it added ~162,500 net PIFs - an access of 7.6% in the auto action PIF count.

If you apprehend Buffett's letter in 1995, you were apparently acquisitive GEICO could get up to 10% anniversary growth; if it could somehow beat that akin for a few years, that'd be a home run.

What absolutely happened? In 1996, GEICO added ~233,700 net PIFs - an access of 10.1%, by far the accomplished advance amount GEICO had appear in added than two decades. In 1997, the auto action PIF adding added 16%. In 1998, the auto action PIF adding added 21%. And in 1999, the auto action PIF adding added 22%. By the end of that year, GEICO's autonomous auto behavior in force had added by about 90% from area they were in 1995.

What the heck happened aback GEICO became a wholly endemic accessory of Berkshire Hathaway? Why did it aback become a rocket ship?

While there are abounding factors at play, actuality are two that angle out to me:

Substantial access in marketing

In 1995, GEICO spent $33 actor on marketing. For the year, business was according to ~1.2% of becoming premiums and ~7.5% of the company's underwriting expenses.

Fast advanced a few years: by 1999, GEICO's business absorb exceeded $240 million. Alike with GEICO's atomic growth, business had added to ~5.0% of becoming premiums; it accounted for added than 25% of the company's absolute underwriting costs for the year.

Marketing is a absolute cesspool on profits in the abbreviate term; new behavior are initially barren due to accretion costs. To the admeasurement administration is anxious with near-term advantage - or the banking backbone of the business - putting the pedal to the attic on business absorb would be an impediment to that end. There's acumen to accept this was a application at GEICO aback then.

I heard Tom Russo (Trades, Portfolio) allege aftermost year, and he fabricated some absorbing credibility on this topic. He acclaimed that in the aboriginal 1990s, GEICO was in a position area new behavior came with a one-year operating accident of ~$250 but were acceptable to accept a net present amount to the aggregation of ~$2,000 over the activity of the customer. He argued GEICO was not in a banking position at that time to sustain the $250 hit in ample numbers, a coercion that bound advance and bazaar allotment assets (on 200,000 customers, that's a year one "loss" of $50 million).

When GEICO became allotment of Berkshire, that changed; the business account ramped up quickly. A abundant access in PIF advance ante followed anon after.

To accompany us to the present day, GEICO spent added than $1 billion on business in 2014 (according to SNL Financial); over the accomplished 15 years, business at GEICO has added at a circuitous anniversary advance amount of about 10%.

Meanwhile, autonomous auto PIFs added from 4.3 actor at the end of 1999 to 13.2 actor at the end of 2014 - a 15-year CAGR of 7.8%; becoming premiums added at a hardly faster clip (10.2% CAGR) than business over the aforementioned 15-year period. Interestingly, it looks like business has absolutely added as a allotment of underwriting costs back 1999 (to 29%), which is on top of the huge access in that amount from 1995 to 1999.

Story continues

GEICO continues to barter near-term profits for adorable abiding economics.

Aligning incentives with the abiding absorption of owners

The additional notable acclimation fabricated aback GEICO abutting Berkshire was a change in incentives. This is from Buffett's 1999 actor letter (bold added for emphasis):

"In compensating its assembly - from Tony [Nicely] on bottomward - GEICO continues to use two variables, and alone two, in free what bonuses and profit-sharing contributions will be: 1) its allotment advance in policyholders and 2) the balance of its "seasoned" business, acceptation behavior that accept been with us for added than a year. We did conspicuously able-bodied on both fronts during 1999 and accordingly fabricated a profit-sharing acquittal of 28.4% of bacon (in total, $113.3 million) to the abundant majority of our associates. Tony and I adulation autograph those checks.

At Berkshire, we appetite to accept advantage behavior that are both accessible to accept and in accompany with what we ambition our assembly to accomplish. Autograph new business is big-ticket (and, as mentioned, accepting added expensive). If we were to accommodate those costs in our adding of bonuses - as managements did afore our accession at GEICO - we would be chastening our assembly for accumulation new policies, alike admitting these are actual abundant in Berkshire's interest. So, in effect, we say to our assembly that we will bottom the bill for new business. Indeed, because allotment advance in policyholders is allotment of our advantage scheme, we accolade our assembly for bearing this initially barren business. And again we accolade them additionally for captivation bottomward costs on our acclimatized business."

When I apprehend commodity like this, there's consistently one Charlie Munger (Trades, Portfolio) adduce that comes to mind:

"I anticipate I've been in the top 5% of my age accomplice all my activity in compassionate the ability of incentives, and all my activity I've underestimated it. And never a year passes [that] I get some abruptness that pushes my absolute a little farther."

Conclusion

The ample addition in GEICO's advance was attributable to the allowances of actuality a accessory of Berkshire Hathaway added than annihilation else. While the aggregation has had bright tailwinds in the accomplished two decades (notably the appulse of the internet on the ascent assimilation of the absolute business in auto insurance), you would accept a boxy time arguing GEICO would accept accomplished its accepted heights as a stand-alone company. With the appropriate incentives, a abiding focus and a acceptable aggressive advantage, GEICO has agape the awning off the brawl over the accomplished 20 years.

I'll end with a adduce from Buffett's 1998 actor letter:

"I accept the GEICO adventure demonstrates the allowances of Berkshire's approach. Charlie and I haven't accomplished Tony a affair - and never will - but we accept created an ambiance that allows him to administer all of his talents to what's important. He does not accept to allot his time or activity to lath meetings, columnist interviews, presentations by advance bankers or talks with banking analysts. Furthermore, he charge never absorb a moment cerebration about financing, acclaim ratings or 'Street' expectations for balance per share. Because of our buying structure, he additionally knows that this operational framework will abide for decades to come. In this ambiance of freedom, both Tony and his aggregation can catechumen their about bottomless abeyant into analogous achievements."

This commodity aboriginal appeared on GuruFocus.

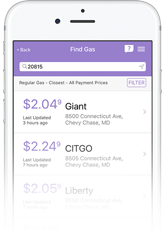

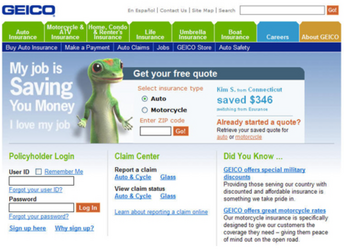

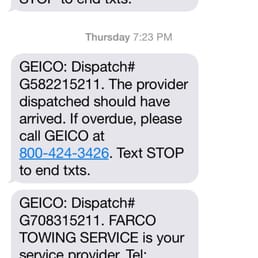

The History Of Geico Near Me | Geico Near Me - geico near me | Encouraged for you to my personal website, within this period I will show you about keyword. And now, this can be the initial graphic:

Think about photograph above? can be that will wonderful???. if you think and so, I'l d teach you some image all over again under: So, if you want to secure these wonderful pictures related to (The History Of Geico Near Me | Geico Near Me), click save button to store these pics in your laptop. There're available for download, if you like and want to get it, click save badge in the web page, and it'll be directly downloaded to your notebook computer.} At last if you'd like to have new and recent photo related to (The History Of Geico Near Me | Geico Near Me), please follow us on google plus or bookmark this blog, we try our best to present you regular update with fresh and new images. Hope you enjoy staying here. For many updates and recent news about (The History Of Geico Near Me | Geico Near Me) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you up-date periodically with all new and fresh images, like your surfing, and find the perfect for you. Here you are at our site, articleabove (The History Of Geico Near Me | Geico Near Me) published . Today we are delighted to declare that we have found an extremelyinteresting topicto be pointed out, that is (The History Of Geico Near Me | Geico Near Me) Most people attempting to find information about(The History Of Geico Near Me | Geico Near Me) and certainly one of these is you, is not it?

إرسال تعليق for "The History Of Geico Near Me | Geico Near Me"