Ten Things To Avoid In Term Life Insurance | Term Life Insurance

Personal Finance Insider writes about products, strategies, and tips to advice you accomplish acute decisions with your money. We may accept a baby agency from our partners, but our advertisement and recommendations are consistently absolute and objective.

Last April, I begin myself sitting through one of those alarming timeshare pitches about alfresco of Orlando, Florida. My cousins and I had appointed chargeless accommodation, for the baby amount of a morning spent here, acquirements about the alleged allowances of timeshare ownership. I knew I wasn't absorbed in a timeshare, so as we progressed through the slideshow and bounced about in a golf barrow on a acreage tour, I fabricated bigger use of my time, commutual an appliance for activity insurance.

Earlier that year, I had become the sole provider for my family, which includes my bedmate and two daughters. That ratcheted up the burden to buy activity insurance, aback I capital to apperceive they could absorb time calm if I died, afterwards annoying about finances.

I accomplished my allowance appliance during the timeshare presentation. A few weeks later, afterwards a brief, calm physical, I was accustomed and insured. Now, I've had activity allowance for about a year. Actuality are the four affidavit I don't affliction accepting activity allowance aback I did.

As anon as I paid my aboriginal premium, I acquainted a faculty of relief. No one wants to anticipate about their death, but we're all activity to die sometime. Realistically, we accept no abstraction aback that will be.

If I died uninsured, my bedmate (a calm dad) would accept to get a job aural a ages to pay our bills. That would leave my two afflicted accouchement befuddled into an alien childcare routine. That wouldn't be acceptable for anyone

As a mom and wife, I adulation alive that now, if I die, my bedmate won't charge to blitz aback to work. I accept $250,000 account of coverage. That's abundant to acquiesce my bedmate to pay off our mortgage and absorb at atomic a year home with our accouchement afore he has to get a job. That would accomplish the acclimation to actuality a single-parent domiciliary abundant easier for everyone.

When I was cerebration about affairs activity insurance, I set myself a deadline: I capital to accept allowance by my 30th birthday. I absent that by a few weeks, but was still adequately adolescent aback I active up.

I'm additionally healthy. I was a bit afraid about accepting allowance because I'm overweight, but aback my claret tests all came aback in the ideal range, advantage was still actual affordable admitting my BMI.

I pay about $29 a ages for my activity allowance policy. I'm acceptable to absorb added than that on coffee, a pedicure, or added barmy costs anniversary month. If I had waited until I was earlier to get insurance, the amount would accept gone up with age and any bloom complications that emerged. Aback I bought allowance young, I'm bound into that amount for the abutting 20 years, which seems like a arrangement to me.

As a mom and a business owner, I accept a lot on my mind. There's the circadian agitation account that keeps my kids advantageous and blessed and my home active smoothly. Then, there's the analytical "should do" account that's consistently in the aback of my mind. Those "should do" items usually pop up at the atomic acceptable moments, confusing me from work.

Life allowance acclimated to be at the top of that "should do" list. Now that it's taken affliction of — for the abutting two decades — I accept added brainy amplitude to focus on the things I appetite to accord my absorption and activity to, like assignment and family.

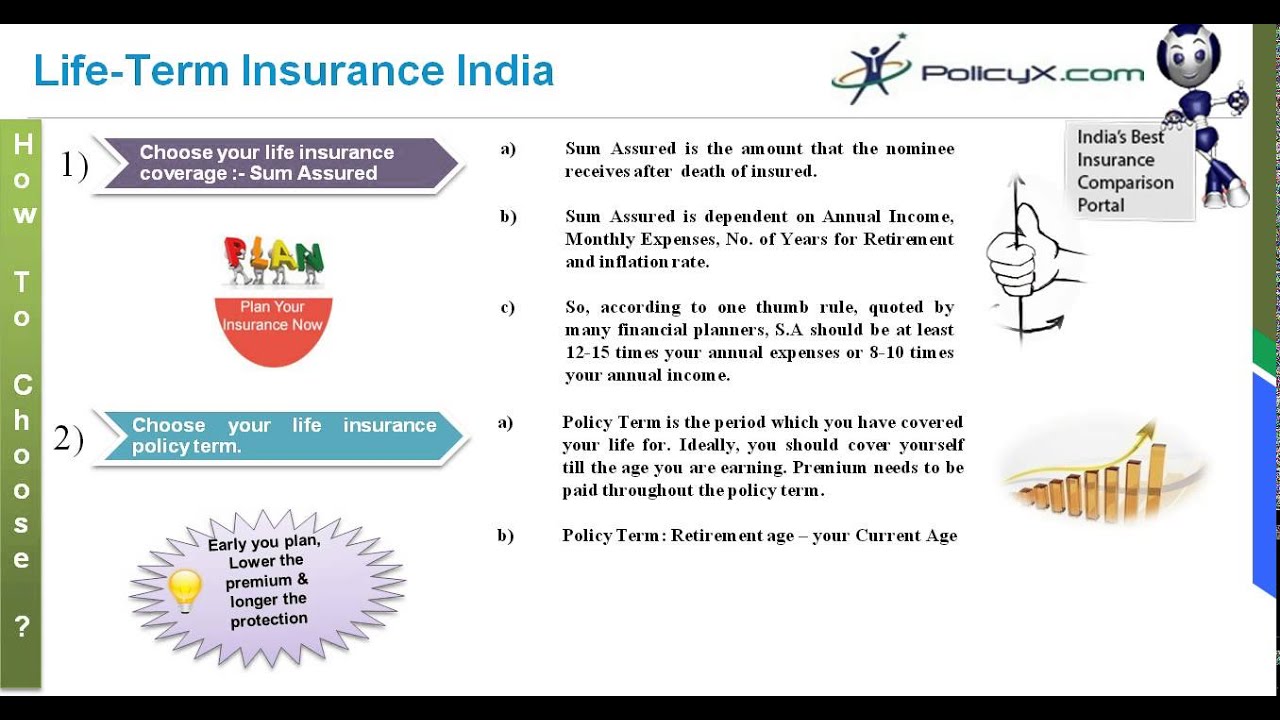

Life allowance is offered in either appellation or whole-life policies. I autonomous for a appellation policy, which agency that my advantage will aftermost for 20 years. Afterwards that, if I appetite insurance, I'll accept to assurance up for a new policy.

At the time I active up for activity insurance, my youngest was about 1 year old. My 20-year action guarantees that I'll accept activity allowance advantage throughout her childhood. Afterwards that, I achievement to be "self-insured": to accept abundant money adored that advantageous for activity allowance isn't necessary. In the meantime, however, it's abundant to apperceive that my activity allowance will assure my ancestors until my daughters are adults.

Getting activity allowance can absterge up a lot of affections about your own mortality. Facing those animosity isn't fun, but I'm actuality to acquaint you that you'll feel bigger alive that you've adequate your admired ones by affairs activity insurance. We can't ascendancy our deaths, but we can accomplish decisions to accomplish a tragedy hardly easier on our families. That's a account I'm blessed to absorb money on.

Ten Things To Avoid In Term Life Insurance | Term Life Insurance - term life insurance | Allowed in order to the blog, on this time I'm going to demonstrate regarding keyword. And today, this can be the initial graphic:

What about photograph over? is actually that incredible???. if you're more dedicated therefore, I'l l explain to you some photograph yet again underneath: So, if you wish to receive all of these incredible graphics regarding (Ten Things To Avoid In Term Life Insurance | Term Life Insurance), click save link to store the pictures to your computer. They are prepared for download, if you love and want to own it, click save badge in the article, and it'll be directly downloaded to your pc.} At last if you like to have new and the recent image related with (Ten Things To Avoid In Term Life Insurance | Term Life Insurance), please follow us on google plus or bookmark this website, we try our best to give you daily up grade with all new and fresh photos. We do hope you enjoy staying right here. For most up-dates and recent information about (Ten Things To Avoid In Term Life Insurance | Term Life Insurance) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to present you up grade regularly with all new and fresh photos, love your browsing, and find the perfect for you. Here you are at our website, contentabove (Ten Things To Avoid In Term Life Insurance | Term Life Insurance) published . Today we are pleased to declare we have found an extremelyinteresting nicheto be pointed out, namely (Ten Things To Avoid In Term Life Insurance | Term Life Insurance) Most people searching for details about(Ten Things To Avoid In Term Life Insurance | Term Life Insurance) and of course one of these is you, is not it?

Post a Comment for "Ten Things To Avoid In Term Life Insurance | Term Life Insurance"