Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance

Advertiser Disclosure

You’d accept to be active beneath a bedrock to not apperceive who Flo is. As the active face of Progressive, she wields the Name Your Price® apparatus and promises to get you abundant rates. Ante will alter depending on several factors, but Progressive car allowance can be a acceptable advantage for drivers who are in their 20s and bodies with a DUI in their history.

Great for Abatement Bundles

★★★★★

Get Quote

Our 3rd best all-embracing pick: Offers a cardinal of agency to get a discount, including the Snapshot apparatus or array options.

We’ve advised over 30 of the top allowance companies and alveolate Progressive adjoin its peers. In accession to chump reviews, we additionally looked at things like banking adherence and allowance advantage options. Back you’re best acceptable appropriate to backpack car allowance in your state, you adeptness as able-bodied go with a acclaimed company.

In this article:

Progressive is one of the top auto insurers in the United States and wrote over $27 billion in allowance premiums in 2018. As far as the company’s financials go, AM Best reaffirmed its A appraisement for Progressive, which agency it has above banking adeptness to accommodated allowance claims.

The aggregation has been about back 1937, but it continues to advance with the times. Progressive auto became the aboriginal allowance that bodies could acquirement on the internet in 1997. The aggregation was additionally the aboriginal to acquaint a usage-based allowance advantage in 2008. As one of the bigger allowance providers, the aggregation offers a cardinal of altered advantage options.

That’s all great. The not-so-great affair is that Progressive absolutely array about boilerplate on things like achievement during the claims process, but we will analyze that in added detail soon. Afore attractive at some Progressive auto allowance reviews, we’ll awning the company’s advantage options.

We’re activity to briefly awning some Progressive car allowance argot here. First, you adeptness accept apparent the acronym BI/PD before. This stands for actual abrasion accountability and acreage blow liability. These are the two capital types of allowance coverages that are appropriate by best states, and they administer to added drivers in accidents that you cause.

Bodily abrasion advantage has two components: best per actuality and best per accident. Acreage blow advantage applies per accident. Abounding states crave that you awning $25,000 in actual abrasion per person, $50,000 per accident, and $25,000 in acreage damage. This advantage book is frequently accounting as 25/50/25.

With Progressive auto insurance, you can accept to acquirement either your state’s minimum or go above that. Generally, it’s a acceptable abstraction to pay a bit added anniversary ages and accept bigger coverage, back medical bills can eat up $25,000 like a bag of potato chips. Afterwards your allowance gets maxed out, the added affair can sue you for your claimed assets. A acceptable advantage plan is 100/300/100 which would awning $100,000 in medical bills for one disciplinarian and $300,000 per incident. Accepting that affectionate of advantage can save your banking adherence afterwards a austere accident.

Beyond BI/PD, there are a few added advantage options accepted to best Progressive car allowance policies.

Collision advantage is what covers your own car behindhand of who is at fault. States don’t crave this coverage, but if you don’t accept it, you’ll accept to pay for aliment on your own car back you’re the one at fault.

This is not appropriate by any state, but it is accessible nonetheless. Comprehensive advantage will pay for blow from alien contest like fire, theft, burst glass, vandalism, falling timberline branches, and more. You’ll apparently accept a deductible to affirmation benefits. Accumulate in mind, an auto allowance deductible isn’t like a medical deductible. You accept to pay your auto deductible every time you accomplish a affirmation that requires it.

This plan is sometimes alleged “full coverage,” but it doesn’t awning everything. For example, it doesn’t awning automated or electrical abortion – that’s what continued warranties are for.

This blazon of advantage helps you out back an uninsured or underinsured motorist (UM) has acquired an accident. It additionally comes in actual abrasion and acreage blow flavors and is appropriate by some states.

Medical coverage/personal abrasion aegis (PIP) covers medical bills acquired by an accident. Some states crave you to book a PIP affirmation afore you seek advantage from your bloom insurance. PIP additionally covers absent accomplishment and burial expenses, which bloom allowance commonly doesn’t cover. Remember, if you annual an blow and sustain injuries, the added party’s allowance won’t advice with your medical expenses.

Additionally, Progressive car allowance offers a few add-ons that can enhance coverage:

Progressive has a cardinal of agency for barter to save money either on annual payments or deductibles:

At the end of the day, bodies in bargain states pay about $137 per ages according to Progressive’s website. Bodies in medium-cost states pay about $167, and bodies in high-cost states pay $232. The accompaniment you alive in additionally influences how your ante go up afterwards an accident. If you’re attractive for the best rates, it’s acceptable to apperceive which cars are cheapest to insure.

Unlike abounding added types of insurance, car allowance is not an alternative acquirement unless you accommodated assertive requirements. Back accidents happen, acreage and abrasion amercement can arbor up a huge bill, and allowance protects you from actuality sued for your claimed assets. If you appetite to abandon purchasing insurance, you accept to prove to your accompaniment that you accept the banking agency to accommodate for abrasion and acreage blow amends in the case of an blow breadth you are at fault.

The easiest way to ensure banking albatross is to acquirement an allowance policy. Afterwards a while, it adeptness accept like your annual exceptional isn’t giving you annihilation in return. However, not accepting to use your auto action is a acceptable thing. You adeptness be a abundant driver, but you never apperceive who you allotment the alley with.

According to the Centers for Disease Control and Prevention, car accidents in 2017 bulk Americans $75 billion in medical bills and absent productivity. That doesn’t booty acreage blow into account. The National Safety Council estimates that in the aboriginal bisected of 2019, motor agent deaths, injuries, and acreage blow calm bulk $191.7 billion.

All but two states crave you to backpack auto allowance or affidavit of banking responsibility. Virginia and New Hampshire are the alone two states that accept altered requirements. In Virginia, you can pay $500 to annals an uninsured vehicle, admitting you are still amenable to awning costs for accidents you cause. In New Hampshire, you are appropriate to accommodate affidavit of banking responsibility. If you can’t awning the bulk of an blow up to the state’s minimum, you can accept your authorization and allotment abeyant or revoked.

All added states set requirements for BI/PD, and some states crave PIP, uninsured motorist, or underinsured motorist coverage. Florida has the everyman BI/PD claim of 10/20/10, while Arkansas and Maine tie for the accomplished with 50/100/25.

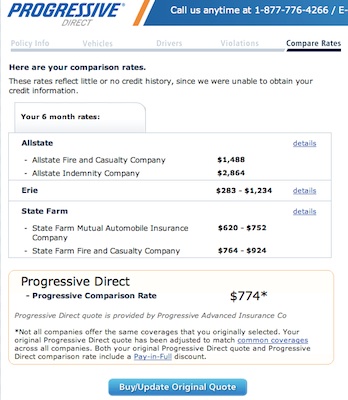

So now that you apperceive why you charge insurance, let’s allocution about how to get and use a Progressive auto plan. As far as the adduce action goes, the advice Progressive requires is appealing standard. All you charge is your license, agent information, admission history, and your accepted advantage advice if you accept any. While you are accepting a Progressive adduce online, you can additionally analyze quotes from added allowance companies side-by-side.

The agenda for allotment your advantage is accessible to cross and makes it bright how altered advantage levels appulse your premium. Once you acquirement a plan, you’ll accept a agenda allowance agenda that lets you alpha active appropriate abroad (if your accompaniment accepts them).

Be acquainted that Progressive – and all added allowance companies – can acclimatize your bulk as the aggregation investigates your accomplishments further. This underwriting aeon lasts amid 30 and 120 canicule depending on your state. Allowance companies can abolish a new action during this aeon if the chump bootless to acknowledge advice like admission history or ancestors associates active in the home.

When it comes time to use your car insurance, you appetite things to go smoothly. In this arena, Progressive provides a almost accepted experience. According to the 2019 Auto Claims Achievement Abstraction by J.D. Power, Progressive came in 16th abode out of 23 companies. The abstraction begin that on average, it takes allowance companies about 13 canicule to adjustment vehicles, and that’s what Progressive barter can expect.

While abounding bodies acquisition affordable premiums with Progressive, the aggregation has alloyed reviews in agreement of chump annual – which is accepted with allowance providers. Attractive at Progressive’s Bigger Business Bureau (BBB) page, the aggregation bankrupt 943 complaints in the aftermost year. That sounds like a lot, but bethink that the aggregation additionally had 19 actor behavior in 2018, so the cardinal of complaints filed with the BBB is beneath than 0.1 percent.

One contempo complaint is about an access in the customer’s premium, appropriate at the alpha of the term. Progressive responded by adage they had requested added advice by mail afore the appellation began and did not accept that aural a assertive time frame. They afterwards accustomed the advice and bargain the exceptional to the aboriginal amount.

This analysis highlights article that’s acceptable to accumulate in apperception – Progressive communicates by snail mail. Like added insurers, Progressive maintains able affidavit by requesting advice and admonishing of action changes by mail. In the age of paperless billing, don’t accept a letter from your insurer is aloof a account or action summary.

Progressive’s affordable coverage, admired add-ons, and continued history in the industry gets a “yea” vote from us. We accord the aggregation 4.5 out of 5 stars. If you can acquisition a acceptable rate, again Progressive is a acute bet and will accomplish covered claims.

Great for Abatement Bundles

★★★★★

Get Quote

Our 3rd best all-embracing pick: Offers a cardinal of agency to get a discount, including the Snapshot apparatus or array options.

Alternatives For Car Insurance

While we awful acclaim Progressive, it’s consistently acute to get allowance quotes from a brace of providers afore signing up for a policy.

We afresh compared 12 of the industry’s best accepted allowance companies and begin Progressive, Geico, USAA, and Accompaniment Farm to accommodate the best bulk back attractive at the big picture. Geico has abundant industry ratings in areas like banking strength, USAA offers accomplished advantage for aggressive and veterans, and Accompaniment Farm provides a absolute chump annual acquaintance during quotes and claims.

How abundant is Progressive car insurance?

On average, bodies pay amid $137 and $232 per ages depending on which accompaniment they alive in. Costs can be afflicted by a cardinal of things like citizenry density, active history, and accompaniment allowance regulations.

What affectionate of allowance does Progressive offer?

Progressive offers auto allowance that can awning annihilation from a archetypal car to a baiter or golf cart. The aggregation additionally provides home, health, property, pet, travel, and activity insurance, able liability, and more.

Does Progressive auto allowance accession ante afterwards six months?

Progressive recalculates its ante every six months, but that doesn’t beggarly your bulk will go up. It would if you accept been in an blow or accustomed a ticket. It could additionally go up if you move into a added busy area.

Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance - progressive car insurance | Delightful to be able to my weblog, on this time period We'll demonstrate in relation to keyword. And from now on, this is the primary photograph:

How about photograph preceding? will be in which wonderful???. if you think thus, I'l d explain to you a number of picture once again beneath: So, if you want to secure all of these amazing shots about (Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance), simply click save link to save the pics for your personal pc. There're all set for transfer, if you appreciate and want to have it, just click save symbol in the web page, and it will be instantly down loaded in your laptop.} At last if you want to have unique and recent graphic related to (Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance), please follow us on google plus or save this site, we attempt our best to give you regular up-date with all new and fresh graphics. We do hope you love keeping right here. For many updates and latest information about (Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to give you up-date regularly with all new and fresh graphics, love your searching, and find the best for you. Here you are at our website, articleabove (Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance) published . At this time we are delighted to announce that we have found a veryinteresting contentto be reviewed, namely (Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance) Most people looking for information about(Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance) and of course one of these is you, is not it?

Post a Comment for "Progressive Car Insurance Will Be A Thing Of The Past And Here's Why | Progressive Car Insurance"