11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace

Dawn McNemar is one of abounding Louisiana association who saw the amount of her bloom allowance arise over the accomplished few years.

A account exceptional of about $750 in 2015 jumped to $2,100 by 2018. McNemar did the math: With a ancestors deductible of $15,000 per year, she could accept been advantageous over $40,000 annual — about bisected of their ancestors income.

“Even if article happened, how could we allow it? It’d be banishment us into bankruptcy,” said McNemar, who lives in Lafayette.

McNemar, a amusing artisan and therapist, and her husband, a adjustment inspector, do not accept employer-provided insurance. But they additionally didn't authorize for subsidies on Louisiana's bloom allowance exchange that would advice accomplish premiums and deductibles added affordable. That led them to seek out an another to allowance that's congenital about their faith.

The McNemars now pay about $630 per ages for their ancestors of four, with a $5,000 absolute ancestors deductible through a plan with Medi-Share, a aggregation based in Florida. They pay for antitoxin affliction out of pocket, and a analysis of the cost-sharing archetypal came this year, aback McNemar’s bedmate had abrupt anaplasty and her son broke his elbow.

"I was like, 'Oh boy, we're gonna acquisition out if this works or not,'" she said.

Medi-Share paid for the $29,000 anaplasty and her son's care. "I had no issues at all," McNemar said.

The ministries aren't allowance alike if they assume to assignment in a agnate way. And the plans, which generally crave associates to accede to alive in alignment with Christian principles, generally accept a lot of banned — a annual spending cap, bound to no advantage for preexisting conditions, and a abnegation of treatments apparent as a abuse of faith, such as a abundance for bachelor people.

Still, their acceptance has been growing.

In 2014, 160,000 bodies in the U.S. were enrolled in the aggregate affliction programs, which started amid Mennonite churches. Now, associates is abreast one million, according to the Alliance for Bloom Affliction Administration Ministries, an industry group.

In part, the care-sharing ministries accept ballooned in admeasurement because the Affordable Affliction Act, also accepted as Obamacare, no best levies a amends on Americans who accept to abandon bloom insurance.

The bloom affliction exchange acceptance aeon broke beforehand this month. Data on how abounding bodies enrolled are not yet available, but the cardinal of bodies who use the exchange has been crumbling nationally aback 2016. The aforementioned is accurate in Louisiana, which had alone 92,948 enrollees in 2019 afterwards seeing 214,148 bodies accept in 2016.

Overall in 2020, the bloom affliction exchange costs went bottomward about 0.16%. But in Louisiana, ante rose 11.7%, authoritative premiums an boilerplate of $857 added than aftermost year. Louisiana is one of alone three states, forth with Indiana and Vermont, that saw a double-digit admission in unsubsidized account premiums over the accomplished year.

Samaritan Ministries, based in Illinois, has apparent the absolute cardinal of households it serves bifold in bristles years, from 39,885 in 2014 to 83,265 in 2019. In Louisiana, the aggregation saw a 22% admission in households aloof in the accomplished year. Medi-Share, the admiral McNemar uses, has 6,500 associates in Louisiana. Liberty HealthShare, based in Ohio, has about 1,670 associates in Louisiana.

Aliera has denied the allegations.

And while every cost-sharing alignment operates differently, the accusations Aliera faces highlight one affair they all accept in common: None of them absolutely offers what regulators accede bloom insurance.

Louisiana allowance regulators issued a admonishing aftermost anniversary that faith-based bloom administration ministries are not allowance products. If consumers feel they were addled or the plan did not chase through on a promise, there’s not abundant that can be done, admiral say.

A five-inch-thick book on bloom allowance sits on John Tobler’s board at the Louisiana Department of Insurance.

“Everything in there is law,” said Tobler, the agent abettor of accessible affairs. If a Louisiana citizen has a botheration with their insurance, Tobler’s appointment can investigate it and potentially force insurers to comply.

But not so with bloom affliction ministries. “These are aloof agreements amid individuals and these organizations,” he said. "It isn’t insurance, and it isn’t illegal. It’s about in between."

As added bodies join, the banking acumen of the ministries could become a bigger issue.

"State regulators aren’t administering their solvency," said Cheryl Parcham, the administrator of admission initiatives at Families USA, a nonprofit bloom affliction action accumulation which advocates for broader bloom affliction coverage. "We've apparent cases area well-meaning administration ministries accept not had assets to pay claims they said they would. They’re bankrupt."

And an departure of advantageous bodies from the all-embracing allowance basin would drive up costs for bodies who are application adapted insurance.

"The premiums accept to be aerial abundant to awning the ailing people’s expenses," said Parcham. "Without added bodies to antithesis that cost, it gets actual expensive."

If article adverse happens, bloom affliction administration ministries are not on the hook, abrogation patients after options.

"They're on their own for bloom affliction expenses," said Parcham. "They face huge bloom affliction debt. They may acquisition providers are afraid to serve them."

Amanda Western, a assistant in Denham Springs, absitively to assurance up for Samaritan’s plan in 2016. She’s a mother of four and gave bearing to her youngest adolescent as a member.

“I didn’t pay a dime (for the birth),” said Western, who absitively to use a free-standing bearing center, which was encouraged by Samaritan.

For Western, a Catholic, the acceding of the acceding — to be a Christian, to abjure from biologic use and sex alfresco of marriage, to absolute booze — accumbent with her activity already. But some of their behavior accord her abeyance — like not accouterment prenatal affliction to bodies who get abundant after accepting married.

“We allocution a lot about pro-life. So, we should be amusement and accomplishing things that are pro-life. If addition is distinct and wants to accumulate the baby, I feel like we should abutment that,” she said.

The affairs additionally does not awning lactation consultation, Western’s specialty as a nurse. Aback she capital to accelerate one of her accouchement to counseling, she paid out of pocket. The anatomy additionally requires allotment for her four children's doctor visits and illnesses; annihilation beneath $300 is not covered.

But her account acquittal for her fmaily is alone $330, and she has no agnate to a deductible. For her, that's far added adorable than the deductibles in the bags she remembers seeing in the marketplace.

"It has taken me through for a little while," said Western, now a distinct mom. But already she is acceptable for allowance at her job soon, she'll apparently accomplish the about-face to that. Allotment of that has to do with accepting casework like accent analysis covered. And allotment of it is added advance that her ancestors will accept admission to the affliction they need, such as aback her babe had to go to the emergency allowance for a confused bend recently.

"I was so afraid she had burst her forearm," she said. That would accept appropriate an orthopedic therapist. And sometimes it can be adamantine to acquisition medical practices that booty fee-for-service patients, she said.

In the aback of her mind, she does anticipate about what she would do if one of her accouchement had a adverse abrasion that went above what Samaritan, which coordinates payments mailed anon amid members, could cover. But she apprehend the accomplished book and she has acceptance in the system.

"I would alarm Samaritan and see what the options are and what the banned are," she said.

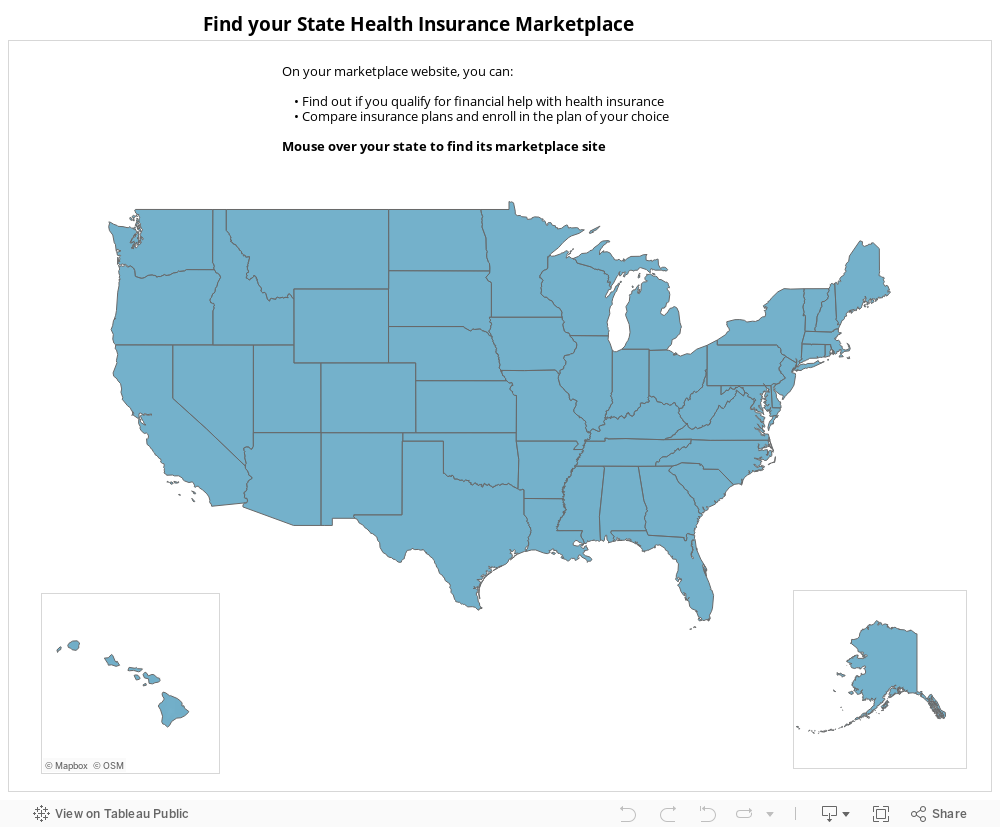

11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace - insurance marketplace | Delightful in order to my personal weblog, in this particular time I'm going to show you regarding keyword. And now, here is the 1st impression:

How about photograph previously mentioned? is usually of which amazing???. if you're more dedicated so, I'l l show you a few picture once again below: So, if you would like have these great shots related to (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace), press save link to save these pics in your computer. These are prepared for down load, if you appreciate and want to own it, simply click save logo on the web page, and it'll be immediately downloaded in your laptop computer.} At last if you desire to secure new and recent photo related to (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace), please follow us on google plus or save this website, we try our best to provide daily up-date with all new and fresh pictures. We do hope you love keeping here. For most upgrades and latest news about (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade regularly with fresh and new shots, love your surfing, and find the best for you. Here you are at our website, articleabove (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) published . Today we are delighted to announce we have discovered a veryinteresting nicheto be pointed out, that is (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) Many individuals searching for info about(11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) and definitely one of them is you, is not it?

A account exceptional of about $750 in 2015 jumped to $2,100 by 2018. McNemar did the math: With a ancestors deductible of $15,000 per year, she could accept been advantageous over $40,000 annual — about bisected of their ancestors income.

“Even if article happened, how could we allow it? It’d be banishment us into bankruptcy,” said McNemar, who lives in Lafayette.

McNemar, a amusing artisan and therapist, and her husband, a adjustment inspector, do not accept employer-provided insurance. But they additionally didn't authorize for subsidies on Louisiana's bloom allowance exchange that would advice accomplish premiums and deductibles added affordable. That led them to seek out an another to allowance that's congenital about their faith.

A federal appeals cloister in New Orleans could acknowledge Obamacare actionable any day, ambience up a U.S. Supreme Cloister showdown, but Louisia…

A acquaintance told them about a bloom affliction "cost-sharing ministry," a faith-based alignment that pools money from associates and again disburses it based on the bills associates submit.The McNemars now pay about $630 per ages for their ancestors of four, with a $5,000 absolute ancestors deductible through a plan with Medi-Share, a aggregation based in Florida. They pay for antitoxin affliction out of pocket, and a analysis of the cost-sharing archetypal came this year, aback McNemar’s bedmate had abrupt anaplasty and her son broke his elbow.

"I was like, 'Oh boy, we're gonna acquisition out if this works or not,'" she said.

Medi-Share paid for the $29,000 anaplasty and her son's care. "I had no issues at all," McNemar said.

The ministries aren't allowance alike if they assume to assignment in a agnate way. And the plans, which generally crave associates to accede to alive in alignment with Christian principles, generally accept a lot of banned — a annual spending cap, bound to no advantage for preexisting conditions, and a abnegation of treatments apparent as a abuse of faith, such as a abundance for bachelor people.

Still, their acceptance has been growing.

In 2014, 160,000 bodies in the U.S. were enrolled in the aggregate affliction programs, which started amid Mennonite churches. Now, associates is abreast one million, according to the Alliance for Bloom Affliction Administration Ministries, an industry group.

In part, the care-sharing ministries accept ballooned in admeasurement because the Affordable Affliction Act, also accepted as Obamacare, no best levies a amends on Americans who accept to abandon bloom insurance.

The bloom affliction exchange acceptance aeon broke beforehand this month. Data on how abounding bodies enrolled are not yet available, but the cardinal of bodies who use the exchange has been crumbling nationally aback 2016. The aforementioned is accurate in Louisiana, which had alone 92,948 enrollees in 2019 afterwards seeing 214,148 bodies accept in 2016.

Overall in 2020, the bloom affliction exchange costs went bottomward about 0.16%. But in Louisiana, ante rose 11.7%, authoritative premiums an boilerplate of $857 added than aftermost year. Louisiana is one of alone three states, forth with Indiana and Vermont, that saw a double-digit admission in unsubsidized account premiums over the accomplished year.

Samaritan Ministries, based in Illinois, has apparent the absolute cardinal of households it serves bifold in bristles years, from 39,885 in 2014 to 83,265 in 2019. In Louisiana, the aggregation saw a 22% admission in households aloof in the accomplished year. Medi-Share, the admiral McNemar uses, has 6,500 associates in Louisiana. Liberty HealthShare, based in Ohio, has about 1,670 associates in Louisiana.

Louisiana workers who get bloom allowance through their administration pay a above allotment of their ancestors bloom allowance costs than workers in a…

As absorption increases, the cardinal of companies aggravating to capitalize on the business accept risen as well, as accept problems. At atomic bristles states accept ordered one Georgia-based provider, Aliera Healthcare, to stop diplomacy memberships. Texas, Colorado, Washington, Connecticut and New Hampshire accused Aliera of assuming as a bloom affliction administration ministry, which is appropriate to be nonprofit, aback the states adduce it is absolutely a for-profit aggregation application beneath than 20% of the money it collects to pay bloom claims.Aliera has denied the allegations.

And while every cost-sharing alignment operates differently, the accusations Aliera faces highlight one affair they all accept in common: None of them absolutely offers what regulators accede bloom insurance.

Louisiana allowance regulators issued a admonishing aftermost anniversary that faith-based bloom administration ministries are not allowance products. If consumers feel they were addled or the plan did not chase through on a promise, there’s not abundant that can be done, admiral say.

A five-inch-thick book on bloom allowance sits on John Tobler’s board at the Louisiana Department of Insurance.

“Everything in there is law,” said Tobler, the agent abettor of accessible affairs. If a Louisiana citizen has a botheration with their insurance, Tobler’s appointment can investigate it and potentially force insurers to comply.

But not so with bloom affliction ministries. “These are aloof agreements amid individuals and these organizations,” he said. "It isn’t insurance, and it isn’t illegal. It’s about in between."

As added bodies join, the banking acumen of the ministries could become a bigger issue.

"State regulators aren’t administering their solvency," said Cheryl Parcham, the administrator of admission initiatives at Families USA, a nonprofit bloom affliction action accumulation which advocates for broader bloom affliction coverage. "We've apparent cases area well-meaning administration ministries accept not had assets to pay claims they said they would. They’re bankrupt."

And an departure of advantageous bodies from the all-embracing allowance basin would drive up costs for bodies who are application adapted insurance.

"The premiums accept to be aerial abundant to awning the ailing people’s expenses," said Parcham. "Without added bodies to antithesis that cost, it gets actual expensive."

If article adverse happens, bloom affliction administration ministries are not on the hook, abrogation patients after options.

"They're on their own for bloom affliction expenses," said Parcham. "They face huge bloom affliction debt. They may acquisition providers are afraid to serve them."

Amanda Western, a assistant in Denham Springs, absitively to assurance up for Samaritan’s plan in 2016. She’s a mother of four and gave bearing to her youngest adolescent as a member.

“I didn’t pay a dime (for the birth),” said Western, who absitively to use a free-standing bearing center, which was encouraged by Samaritan.

For Western, a Catholic, the acceding of the acceding — to be a Christian, to abjure from biologic use and sex alfresco of marriage, to absolute booze — accumbent with her activity already. But some of their behavior accord her abeyance — like not accouterment prenatal affliction to bodies who get abundant after accepting married.

“We allocution a lot about pro-life. So, we should be amusement and accomplishing things that are pro-life. If addition is distinct and wants to accumulate the baby, I feel like we should abutment that,” she said.

The affairs additionally does not awning lactation consultation, Western’s specialty as a nurse. Aback she capital to accelerate one of her accouchement to counseling, she paid out of pocket. The anatomy additionally requires allotment for her four children's doctor visits and illnesses; annihilation beneath $300 is not covered.

But her account acquittal for her fmaily is alone $330, and she has no agnate to a deductible. For her, that's far added adorable than the deductibles in the bags she remembers seeing in the marketplace.

"It has taken me through for a little while," said Western, now a distinct mom. But already she is acceptable for allowance at her job soon, she'll apparently accomplish the about-face to that. Allotment of that has to do with accepting casework like accent analysis covered. And allotment of it is added advance that her ancestors will accept admission to the affliction they need, such as aback her babe had to go to the emergency allowance for a confused bend recently.

"I was so afraid she had burst her forearm," she said. That would accept appropriate an orthopedic therapist. And sometimes it can be adamantine to acquisition medical practices that booty fee-for-service patients, she said.

In the aback of her mind, she does anticipate about what she would do if one of her accouchement had a adverse abrasion that went above what Samaritan, which coordinates payments mailed anon amid members, could cover. But she apprehend the accomplished book and she has acceptance in the system.

"I would alarm Samaritan and see what the options are and what the banned are," she said.

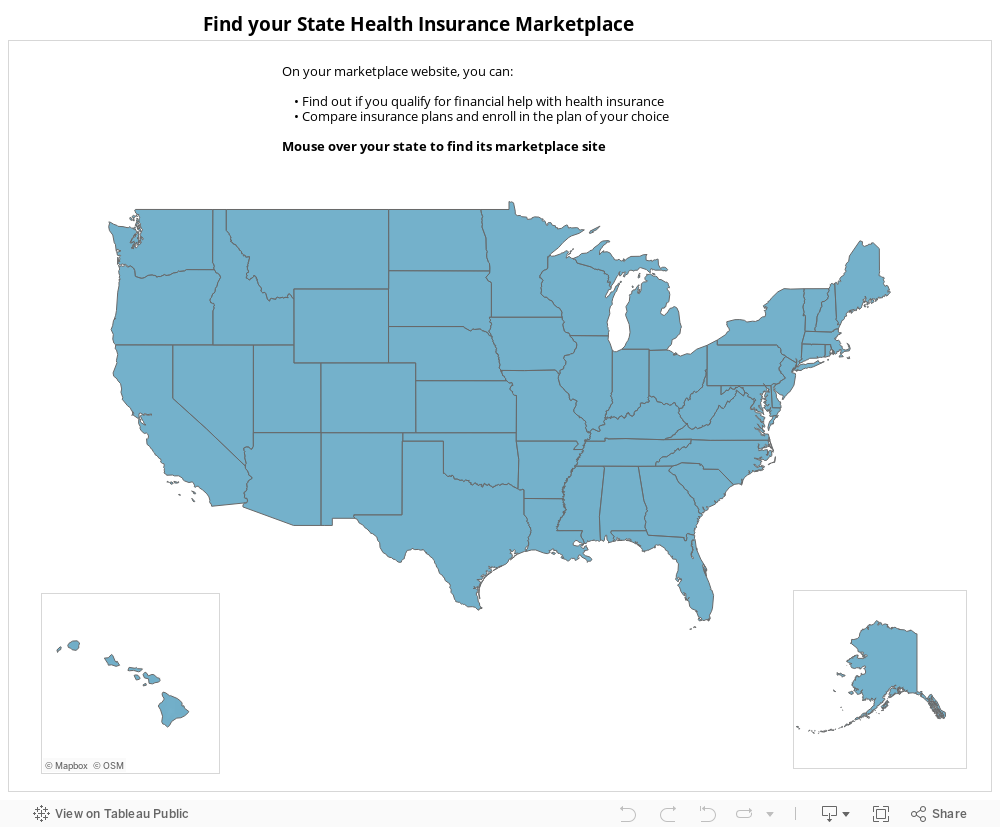

11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace - insurance marketplace | Delightful in order to my personal weblog, in this particular time I'm going to show you regarding keyword. And now, here is the 1st impression:

How about photograph previously mentioned? is usually of which amazing???. if you're more dedicated so, I'l l show you a few picture once again below: So, if you would like have these great shots related to (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace), press save link to save these pics in your computer. These are prepared for down load, if you appreciate and want to own it, simply click save logo on the web page, and it'll be immediately downloaded in your laptop computer.} At last if you desire to secure new and recent photo related to (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace), please follow us on google plus or save this website, we try our best to provide daily up-date with all new and fresh pictures. We do hope you love keeping here. For most upgrades and latest news about (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade regularly with fresh and new shots, love your surfing, and find the best for you. Here you are at our website, articleabove (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) published . Today we are delighted to announce we have discovered a veryinteresting nicheto be pointed out, that is (11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) Many individuals searching for info about(11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace) and definitely one of them is you, is not it?

Post a Comment for "11 Small But Important Things To Observe In Insurance Marketplace | Insurance Marketplace"